There may be a major shift in the play book for your financial advisor. Bitcoin ETF flows gain a dangerous momentum as institutions with large names are preparing to open access to millions of investors. According to HoganBitwise’s chief investment employee, the four largest American wire houses, Merrill Lynch, Morgan Stanley, Wells Fargo, and UBS, are preparing to open ETF Bitcoin gates.

If this happens, he may put a lot of encryption in the hands of the main investors.

CIO expects $ 12 billion in the two directions of the four large houses to allow their consultants to reach #Bitcoin Investment funds circulated this year.

– Merrill Lynch

Morgan Stanley

– Wales Vargo

UBSInstitutions here.

The following class capital (NextlayCAP) April 30, 2025

These companies are running a 10 trillion dollar assets, so when they move, the entire market feels. Currently, their customers do not have a direct access to the Bitcoin investment funds on their platforms. But Hogan says this changes. Behind the scenes, due care reviews occur, the systems are updated, and the conversations are heated.

Expect? By the end of 2025, consultants in these companies can recommend bitcoin permits as well as shares, bonds and joint investment funds.

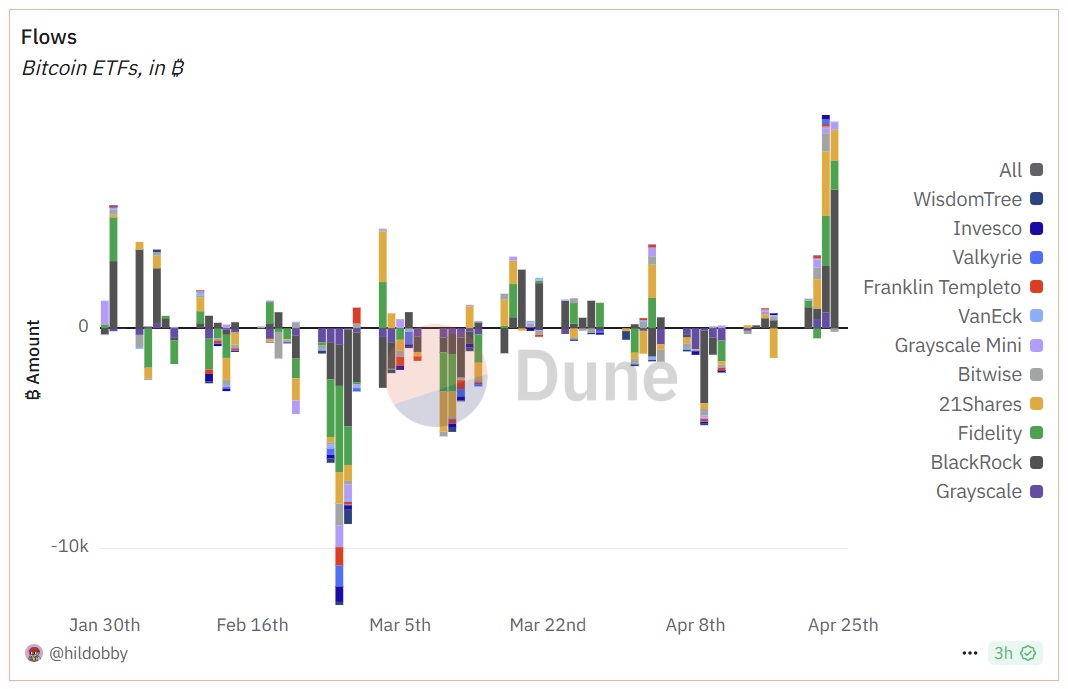

Bitcoin ETF flows so far in 2025

To date, ETF Bitcoin ETF flows show the large investor transformations. Grayscale has seen significant external flows, while Blackrock and Fidelity gained most flows. In late April was a strong return With more than $ 500 million Flow in.

Standard implies expected in the investment funds circulated in Bitcoin

To date, 2025 was slower of Bitcoin ETF flows compared to last year. In 2024, the madness of the launch in the jaw brought 35 billion dollars. This year, we sit about $ 3.7 billion so far. But if the wires open the gates, Hougan says these numbers may explode again, and may determine new records before the end of the year.

It is a “slow, later” case. Hougan believes that once the Bitcoin’s investment funds are offered on the same platforms that manages most of the retirement and mediation accounts in Americans, flows will move from flood to flood. Financial advisers tend to move carefully, but as soon as they arrive, they often stay for a long time.

Convert From retail to institutional investment

One big direction is already playing? Delivery from retail to institutional investors. While the individual investors helped start ETF, the institutions quickly take over.

He discovers: The best new encryption currencies for investment in 2025

Robert Michnik, head of the Blackrock Digital Assets, noted that wealth managers and institutional customers are now responsible for a greater share of ETF Bitcoin assets than individual investors. This is a strong vote on confidence from some of the most careful players in financing.

What can we expect to see from the encryption market?

If the four large sectors begin to offer the investment funds circulating in Bitcoin, we are likely to see more liquidity, the lowest prices are lower, and perhaps more stable floor under the market. It also opens the door for other encryption origins to follow a similar path in traditional wallets.

This is not just a victory for bitcoin lovers. It is a sign that Crypto finds its place in the broader financial system, not a marginal betting, but it is now expected that serious investors will look.

conclusion

We are not there yet, but the wheels turn. If Hougan predicts is a fact and the homes jumped the main wires on board by the end of 2025, the encryption market can enter a completely new stage. This will lead to one of the most important steps so far to fully bring digital assets to the financial current. Investors, Notefor you The advisor may be Bitcoin sooner what you think.

He discovers: 20+ next to the explosion in 2025

Join Discord 99bitcoins News here to get the latest market updates

Main meals

-

The four largest American wires are preparing, Merrill Lynch, Morgan Stanley, Wells Fargo and UBS, to provide investment funds circulating in Bitcoin to their customers.

-

These companies run combined assets worth $ 10 trillion, and opening access to Bitcoin’s investment funds can increase the dramatical dependence of the prevailing encryption.

-

BitWise Cio Matt Hougan predicts that Bitcoin Etf’s flows can reach new records by the end of 2025 once the wire platforms go directly.

-

Founding players are increasingly dominating ETF allocations, which is a shift away from the investment that is driven by retail encryption.

-

If approved, ETFS Bitcoin may lead to wire platforms to increase market liquidity, reduce fluctuations, and integrate the wider wallet.

Post Big Four Wirehouses appeared to cancel the ETF Bitcoin lock for millions of investors for the first time on 99bitcoins.