The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Tom Lee has devoted a topic of six tapes on X yesterday to submit one suggestion: If companies deal with ETHEREM (ETH) in the way that deals with Microstrategy Bitcoin, the distinctive code price only needs to follow mathematics absorbing the turbulence of the turbine to reach approximately $ 30,000. The Lee argument depends on mechanics that says its amazing shares in the field of Microstrategy. From August 11, 2020 to today, the software company shares rose from $ 13 to about $ 455, an increase of 35 times. Lee wrote from 11,000 to $ 118,000 in the same period-while the “Treasury Strategy” was created, which is that 11,000 dollars to $ 118,000 in the same period-while the “Treasury Strategy” was created, which means that only eleven of these came from the height of bitcoin-more than 11,000 dollars to 118,000 dollars in the same period-while twenty-five turns through the “Treasury Strategy”.

Ethereum to $ 30,000?

for me Lists Three movements made the template work, and in his opinion, it will be more effective for ETH: version of new shares higher than the value of the net assets to gain more symbols, and exploit the distinctive symbol fluctuations to reduce borrowing costs, and to rely on transfer or favorite shares to reduce the maximum. Since the achieved ETHER fluctuations still go beyond Bitcoin, Lee argues at the cost of debt and chosen structures used to lift the cabinet can be less than the accumulation of the unique symbol.

Related reading

In the same thread, he republished a scheme that shows that his own car, BitMine Gemersion Technologies, who bought a virtual value four times in the first week of its activity (billion dollars in ETH) from Microstrategy in the first week of Bitcoin purchases in 2020.

The numbers show the scale. A regulatory and follow-up statement confirmed on July 17 that the company now owns 300,657 ETH- only one billion dollars at the time of publication-after the closure of a special site worth $ 250 million on July 8. Lee, who heads the BitMine painting, said that the company “is on our way to get and support five percent of the total supply ETH.”

The second largest treasurer is Sharplink Gaming, headed by the co -founder of Ethereum Joseph Lubin. On July 17, the company has updated its SEC bulletin to increase the shares it could sell from one billion dollars to 6 billion dollars, saying that the revenues would finance additional ETH purchases. Sharplink has already raised $ 413 million between 7 and 11 July, and unveiled 280,706 ETH on its books as of July 13, all except for a few hundred of the return.

Related reading

Digital PT Tours outside the trio. After selling a $ 172 million guarantee on July 7 and liquidating 280 Bitcoin, miners on the Nasdaq Stock Exchange reported 100,603 ETH and announced that its intention would become the “ETH Holding Company in the world”, according to CEO Sam Tabar.

Combated, the three companies now control approximately 682,000 ETH, or about half a percent of the circulating offer, each with active statements to issue more shares or debts explicitly to the accumulation of ether. Lee insists that the reflexive episode created by high stock prices, which provides a subsidiary capital that still buys more distinctive symbol for each share-time price to capture scarcity.

DCINVESTOR, responding to a thread, distilled Mathematics in a group: “Tom Lee is mainly calling for between 30 and 80 thousand dollars, and some of you believe that we will stop 1-2 thousand dollars after the last session of the last.”

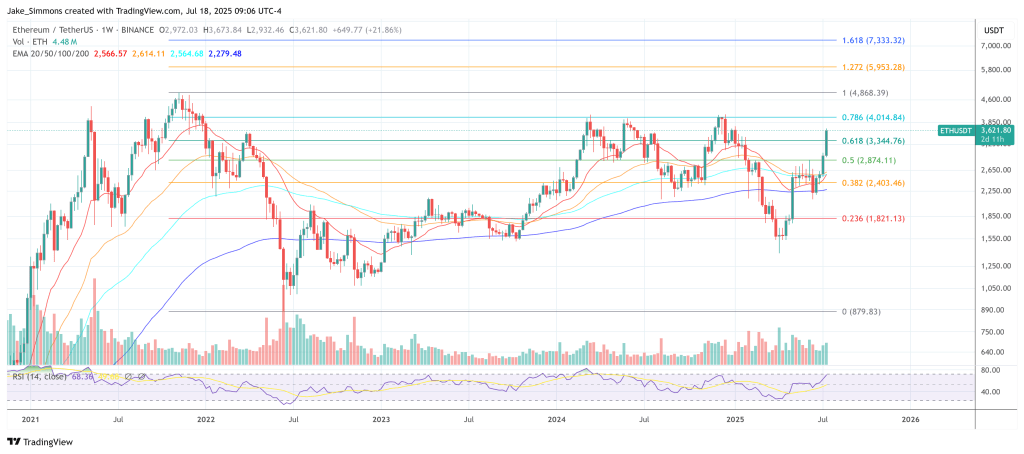

The ether changes today near $ 3,600. The eight -fold step to $ 30,000 would repeat the complications that Bitcoin recorded between the first purchase of the Microstrate and 2021. Ethereum treasury bonds took less than two months to raise the first billion dollars.

Distinctive image created with Dall.e, Chart from TradingView.com